You’re stuck with a huge unpaid credit card debt in Malaysia, that’s understandable. It all began when you maxed out your first card during an emergency, and then you swore to never get another one. Until you did, because another emergency happened.

You’re not alone. According to a report by The Star in 2017, Malaysia has 3.6 million credit card holders with RM36.9 billion outstanding balance! The report added that 43.6% of total cardholders only pay up at least five percents of their outstanding balance, while 12.8% don’t even pay the minimum before or within the due date.

“Capitalism!” You scream. A vicious cycle to keep you in the rat race!

But it doesn’t have to be that way. It’s not too late for you to start taking action and get yourself out of this financial burden. And in this article, Loanstreet and our friends at YIR are going to list the options to do so.

But before that, we want to talk a little bit about… Yayasan Ihsan Rakyat (YIR)

YIR serve Malaysian government staff and work closely with the government to collect and manage contributions so they can empower the people that need them the most.

They offer personal financing with the profit rate from as low as 6.99% per annum. So regardless of your needs – be it settling your debts, covering medical expenses, or starting your own business – now you know two organizations that can help achieve your goals!

Talking about how to settle debts, let’s dive straight into the first method of finishing them, which is…

Contents

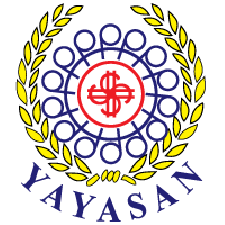

1. Using the snowball method

In the first two methods of this article, we are going to talk about debt repayment strategies. These strategies require nothing else other than your discipline, willpower, and of course, hope. The first one being the snowball method.

In a nutshell, the snowball method is a debt payment strategy where you pay off debts in order from smallest to largest, gaining a momentum as each debt is settled.Here’s how it works:

- Step 1: List your debts from smallest to largest

- Step 2: Make minimum payments on all your debts except the smallestTotal debt and amount owed

- Step 3:Pay as much as possible on your smallest debtLength of credit history and more

- Step 4: Repeat until each debt is settled

This method doesn’t just work for credit cards, but all of your debts as well. Let’s put this into an example. Say you have these five debts, from the smallest to the largest:

- Credit Card B: RM3,800

- Credit Card A: RM1,500

- Personal Loan B: RM18,500

- Personal Loan A: RM10,000

- Car Loan: RM21,000

- PTPTN Loan: RM45,000

Of course, before you even start on these steps, you would have to modify your spending behaviour to squeeze every single Ringgit aside. This means cutting all unnecessary expenses including that overpriced postpaid plans you never fully used anyway.

After trimming down your expenses, paying rent, bill, and petrol – you are left with RM1,000 a month. Instead of using this RM1000 to pay a little extra on all loans at once, you would only make the minimum payment on everything so you can focus the rest of the money on Credit Card A. Within two months, you would have paid off this credit card and never have to think about it again.

Now the extra money freed from Credit Card A could be used to settle Credit Card B within four months. This process would repeat, and by the time you reached your biggest debt which is the PTPTN loan, you would have so much more extra cash accumulated for it, hence the term ‘snowball’.

This method works because it is so satisfying to see one debt out of your life forever, and motivates you to work on the next one until you become fully debt-free. It is also very attractive to beginners because of how easy it is to manage. But if you’re looking for something a little more advanced, you could be…

2. Kaedah Runtuhan Salji (“Avalanche”)

While the snowball method focuses on paying the smallest debt first, the avalanche method focuses on paying the debt with the highest interest rate first.

Using the same example as before, here’s how it would look like with the avalanche method:-

This might sound counterintuitive at first. After all, why would you ever want to settle your debts by… going into another debt? But wait, don’t close your browser tab just yet!

If you’ve never heard of debt consolidation before, it’s an option where you take one big loan to pay all of your smaller loans at once. In other words, debt consolidation simplifies your payment. Instead of having multiple bills with different loan periods, interest rates, and deadlines – you only need to worry about one bill.

3. Settle all your credit cards with another credit card.

There are two popular types of debt consolidations:

- Balance transfer credit card

- Personal loan

Let’s talk about the first one. As the name suggests, you can consolidate the balance from multiple cards into one.

Balance transfer credit card typically offers a lower interest rate to settle the debts. While a normal credit card would have 15%-18% interest rate p.a., balance transfer credit card could offer as low as 0% interest rate p.a. on the debts transferred (not applicable to your regular spending on that credit card). Do take note that such offers typically have their caveats. Firstly, some of them might charge you an upfront handling fee. Secondly, the 0% interest rate might only be applicable if you could settle the debts within 6 months, or the rate would start increasing dramatically.

But come to think of it, if you have the money to settle the debts within 6 months, you most probably have settled each individual cards a long time ago, isn’t it? That being said, let’s move on to the second method of debt consolidation…

4. Settling your credit card with a personal loan

Debt consolidation via a personal loan is really straightforward. Again, you consolidate all of your credit card debts (or any debts for that matter) into one loan. This simplifies multiple debts into one, making it convenient for you to focus on just one bill. However, unlike a balance transfer credit card which is a specific product tailored for settling credit card debts (hence, most of them typically have similar offerings), personal loan gives you a much wider option. There is no specific product for it so you can go with any loans that are best suited for your needs.

So what are those needs? Do you need a loan that gives you the lowest interest with high monthly payment? Or do you need one that gives you more flexibility yet doesn’t penalize you too much for long-term settlement?

You also need to assess your current situation such as your employment and current financial records.

Certain loans have specific priorities that you can take advantage of. For example, YIR give fast approval for government staff and government-linked companies’ (“GLC”) employees. So if you are one of these two groups, you know you are already in front of the queue.

Then of course, take a look at their profit rate. Again, with YIR, their profit rate starts at 6.99% p.a., which is definitely lower than most credit cards at 15%-18%. So have your calculator ready, do your math, then have proper sleep because math is hard, and repeat until you have a solid plan to settle your debts, once and for all.

Acknowledging your financial situation will go a long way

The first thing you need to do is to sit down and figure out how much you owe. It might be daunting to have that knowledge, but it’s the first step towards your financial freedom.

If you’re considering debt consolidation, make sure the calculation checks out. Use a credit card calculator to know how much interest you would accumulate by paying your cards a specific amount every month, and compare it to the interest provided by the banks.

There’s a lot of banks that provide different offers, even servicing different markets. So make sure you analyze the ones that could give you an upper-hand. Like we have mentioned, if you are a government staff or a GLC employee, you can take advantage of YIR that are catered specifically for you.

So if you follow the above smart ways to repay your debts, you could get lower interest rate and get out of debts faster.

At the end of the day, it really boils down to you changing your spending habits. Even after settling all of these debts, you need to make sure that you’ll be more conscious on your every financial decision. And if you need a little nudge to finding the best government personal loan for you, check out Loanstreet’s comparison tool to get instant quotes right at your fingertips!